Mutual Fund Transfer Agent Market: Global Market Analysis and Future Assessment by Mutual Fund Type — 2019-2029

Categories: Banking, Financial Services, and Insurance | Report Code : BFI21308 | No. of Pages : 128

Overview:

The global mutual fund transfer agent market is valued for more than US$ XXX.X Mn in 2019 and expected to reach a value of US$ XXX.X Mn by 2029 with a significant CAGR of around XX.X% over the forecast period of 2019-2029. A mutual fund transfer agent has to perform functions of both the registrar functions and transfer agent. Mutual fund transfer agents are responsible for keeping shareholder account records, preparing & mailing account statement and other notices to shareholders, and calculating and disbursing dividends.

Additionally, the 1940 Investment Company Act stipulates the functions and organization of mutual fund companies. Hence, the fund's transfer agents are bound to follow the act requirements regarding notification and protection of client investment.

Market Dynamics:

Large part of population is now inclining towards mutual funds for investment, which is a major factor driving growth of the global mutual fund transfer agent market. The rising level of returns from the mutual funds as compared to other investment options and low risk associated with mutual fund investment options are other factors boosting growth of the target market.

However, lack of transparency in terms and conditions may hamper growth of the global mutual fund transfer agent market to a certain extent in coming years. Nevertheless, integration of advanced technologies such as big data, artificial intelligence, and digital investment platforms to improve business processes is expected to generate lucrative opportunities for the market growth over the forecast period.

Key Trends:

Rising focus on various product launches among key players to tap the major investors specifically rural investors is a key trend witnessed in the global mutual fund transfer agent market. This is resulting growth in investment across the globe. For instance, a leading India based asset management company offers Power SIP, which allows investors to start SIP in a debt fund of the fund house. However, initially investor need to invest equal to six times to the selected SIP amount. This kind of strategic initiatives expected to fuel growth of the target market in the near future.

Regional Analysis:

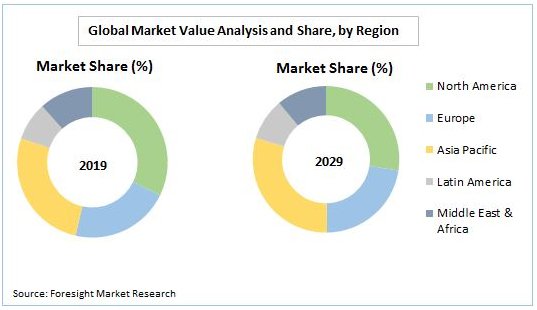

For detailed understanding of market dynamics, the global mutual fund transfer agent market is analyzed across key regions viz. North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. The North America is accounted for the major revenue share in 2019, owing to high awareness about investment among general population in countries in the region. Additionally, high income level of individuals and wide availability of leading players are among the other factors supporting regional market growth.

However, the market in Asia Pacific region is expected to register significant CAGR during the forecast period. This is owing to rising government support and aggressive marketing to spread the awareness about mutual funds in countries such as India.

Scope of the Report:

|

Report Feature |

Details |

|

Base Year: |

2018 |

|

Projection Period: |

2019-2029 |

|

Market Details: |

Total revenue and forecast, CAGR, Market value, share, and Y-o-Y growth by segment and region |

|

Segment Covered: |

Mutual Fund Type |

|

Region Covered: |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Report Coverage: |

Market growth driving factors, challenges & pitfalls, opportunities, trends, key players analysis, and region analysis |

Detailed Segmentation:

Global Mutual Fund Transfer Agent Market, By Mutual Fund Type:

- Closed-end Mutual Funds

- Open-end Mutual Funds

Key Players Covered:

Key players operating in the global mutual fund transfer agent market includes Computershare Limited, HSBC Holdings plc, The Bank of New York Mellon Corporation, Frаnklіn Теmрlеtоn Іntеrnаtіоnаl Ѕеrvісеѕ (Іndіа) Рvt. Ltd, Continental Stock Transfer & Trust Company, Inc, Karvy Group, KFin Technologies Private Limited, American Stock Transfer & Trust Company, LLC, Broadridge Corporate Issuer Solutions, Inc., and Wells Fargo & Company.

Key Features of the Study:

Foresight Market Research provides detailed analysis on global market in our report- Global Mutual Fund Transfer Agent Market by mutual fund type and region. The report provides market size (US$ Mn) and compounded annual growth rate (%) for the forecast period: 2019 – 2029, considering 2019 as the actual year. The report also contains in-depth analysis about market drivers, restraints, opportunities, new product launches, product approval, ongoing trends, and regional outlook. The report delivers competitive analysis about leading players in the global mutual fund transfer agent market based on various parameters such as company overview, product portfolio, regional presence, financial performance, distribution strategies, key developments, marketing strategies, and future plans. The analysis from the report would acquaint the marketers and management authorities of companies to make the appropriate decision with respect to their future product launch, market expansion, and marketing tactics used overall the globe.